Fiscal Policy Refers to

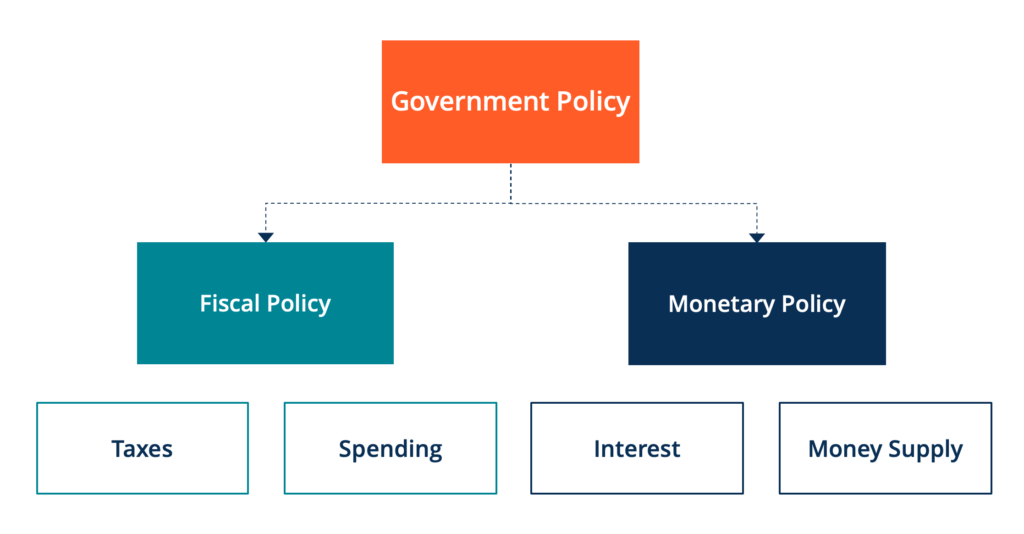

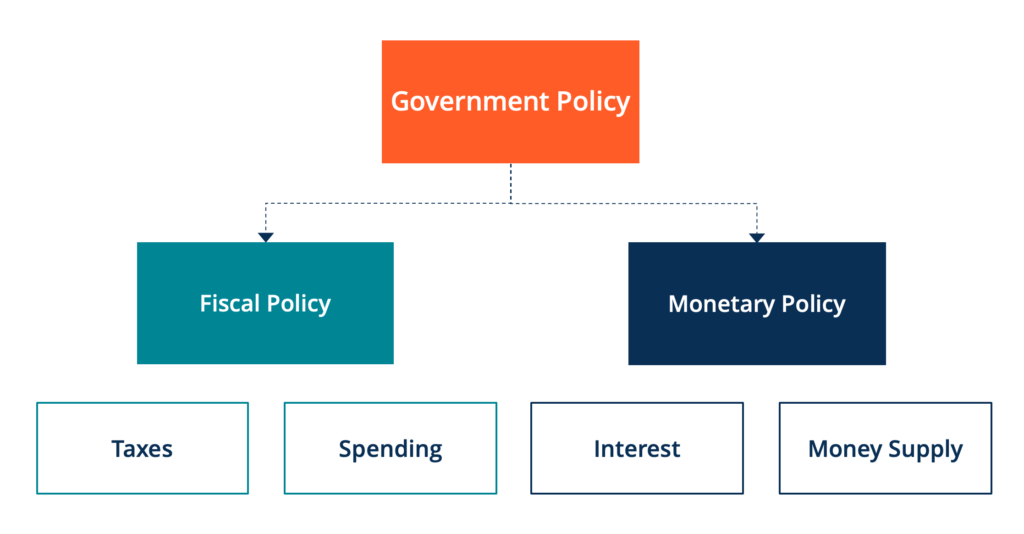

Monetary refers to the supply of money or the amount there is to spend. Economic stimulus refers to attempts by governments or government.

What Is Fiscal Policy Definition And Meaning Market Business News

The amount of tax we pay increases if there is inflation.

. The debate about the impact of fiscal policy on the economy has been raging for over a century but in general its believed that higher government spending helps stimulate the economy while lower spending acts a drag. What is Fiscal Policy. 31 is due.

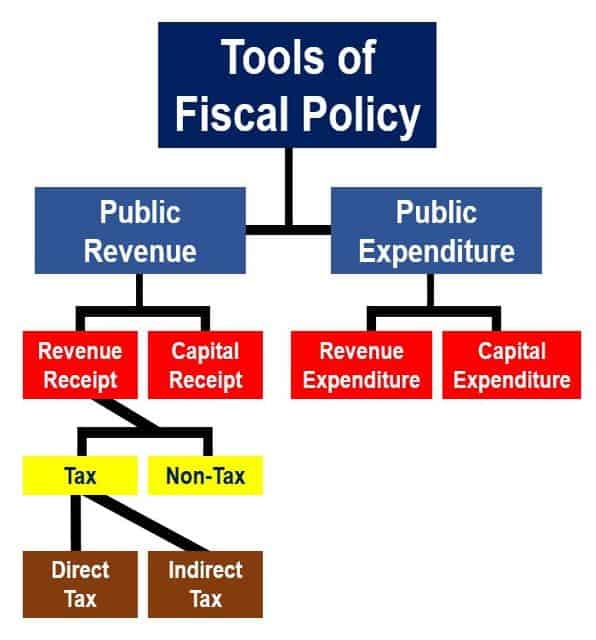

Public debt or borrowing refers to the government borrowing from the public. This is because with rising wages more people will slip into the top income tax brackets. Fiscal policy is the management of government spending and tax policies to influence the economy.

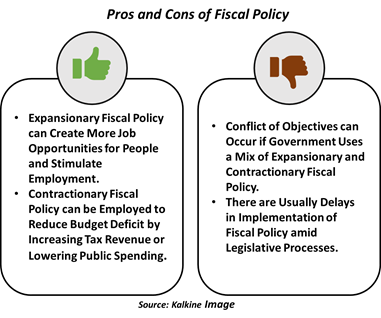

In this context it may refer to. An expansionary fiscal policy involves increasing spending or cutting taxes to prevent or end a recession or depression. C full employmentD public debt.

Fiscal usually refers to government finance. In periods of nominal wage restraint even a small increase in inflation can lead to a fall in real wages. The Fiscal Law philosophy is that expenditure of funds is proper unless prohibited.

Its purpose is to expand or shrink the economy as needed. Fiscal policy refers to A. Fiscal policy use of government expenditure to influence economic development.

The reason that a companys fiscal year often differs from the calendar year and may not close on Dec. In economics and political science fiscal policy is the use of government revenue collection taxes or tax cuts and expenditure to influence a countrys economy. Discretionary fiscal policy refers to government policy that alters government spending or taxes.

For instance when the UK government cut the VAT in 2009 this was intended to produce a boost in spending. Changes in the money supply. It is impossible for a government to default on its equity since the total returns available to all.

What is fiscal policy. Fiscal policy refers to changes in tax rates and public spending. B Suppose the government purposely changes the economys cyclically adjusted budget from a deficit of 0 percent of real GDP to a deficit of 3 percent of real GDP.

The government is engaging in an A. Fiscal implies the budget or how the money will be spent. The government uses these two tools to influence the economy.

On its own fiscal policy is the collection and expenditure of revenue by government. Congress sets fiscal policy with a lot of input from the executive branch. Now expansionary fiscal policy refers to a policy that seeks to grow the economy through fiscal stimulus.

It is the sister strategy to monetary policy. Such policies are framed concerning their impact on the country ie on consumers organizations investors foreign markets etc. Changes in the interest rate.

Fiscal policy refers to the actions of a governmentnot a central bankas related to taxation and spending. The effects of fiscal and monetary policy on output Monetary policy and the transmission mechanism The liquidity trap The classical case The quantity theory of money Fiscal policy and crowding out Monetary accommodation The effects of alternative policies on the composition of output The US. Monetary policy vs.

Fiscal policy is a much broader category than monetary policy. Fiscal policy refers to government measures utilizing tax revenue and expenditure as a tool to attain economic objectives. Public defence or welfare payments.

Changes in the amount of physical capital in the economy. Explore the tools within the fiscal policy toolkit such as expansionary and contractionary fiscal. 33 terms The amount by which government expenditures exceed revenues during a particular 37 year is the A GDP gap.

Discretionary changes in government spending and taxes. Fiscal year-end is the completion of a one-year or 12-month accounting period. In other words fiscal policy refers to how government collects money through taxes and what it spends money on ie.

Tru e Fals e 4 points QUESTION 6 The Judge Advocate Generals Legal Center and School decided to upgrade the audiovisual. It accepts voluntary services It commits funds prior to obligation It exceeds funds available within a formal subdivision A and C 4 points QUESTION 5 True or False. Fiscal policy refers to the budgetary policy of the government which involves the government controlling its level of spending and tax rates within the economy.

Fiscal adjustment a reduction in the government primary budget deficit. CHAPTER 11 MONETARY AND FISCAL POLICY Chapter Outline. All taxing and spending decisions made by Congress fall into the category of fiscal policy.

Fiscal Policy Overview Of Budgetary Policy Of The Government

What Is Fiscal Policy Definition And Meaning Market Business News

What Is Fiscal Policy It Is An Essential Tool At The Disposable Of The Government To Influence A Nation S Econo Economics Lessons Teaching Economics Economics

Fiscal Policy Definition Meaning In Stock Market With Example

0 Response to "Fiscal Policy Refers to"

Post a Comment